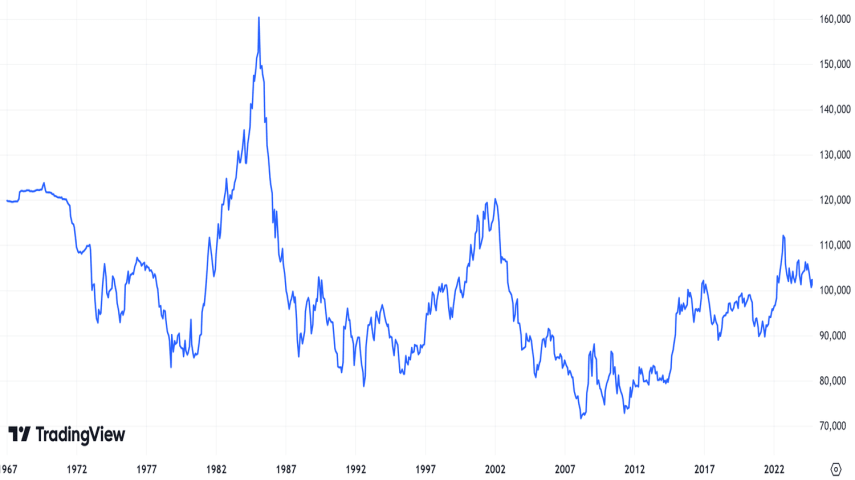

The US Dollar Index (DXY) edges higher to around 99.85 on Friday, rebounding from weekly lows near 99.65 as risk-off sentiment grips global markets. Investors are turning cautious amid growing fears of an AI-driven equity bubble, which has sparked sell-offs in both Wall Street and Asian markets.

The Greenback is finding renewed support as traders seek safety following weak US private employment data. Reports from Revelio Public Labor Statistics and Challenger, Gray & Christmas revealed that US job cuts surged to their highest level in 22 years in October, with companies trimming staff as AI adoption accelerates and cost pressures rise.

The prolonged US government shutdown, which has delayed key reports like Nonfarm Payrolls, has further heightened uncertainty. With investors wary ahead of remarks from Federal Reserve officials and the University of Michigan’s Consumer Sentiment Index, the Dollar’s safe-haven appeal remains intact near the crucial 100.00 level.